pay indiana state estimated taxes online

To make an individual estimated tax payment electronically without logging in to INTIME. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

E File Indiana Taxes Get A Fast Refund E File Com

For best search results enter a partial street name and partial owner name ie.

. There are several ways you can pay your Indiana state taxes. For more information on DORs tax system modernization efforts visit Project NextDOR at doringovproject-nextdor. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165.

Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. You will receive a confirmation number immediately after paying electronically via INTIME. Send in a payment by the due date with a check or money order.

Unlike the federal income tax system rates do not vary based on income level. These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July 18 2022. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. As of September 7 2021 Individual estimated payments can be made using INTIME. Know when I will receive my tax refund.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. 124 Main rather than 124 Main Street or Doe rather than John Doe. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

Contact the Indiana Department of Revenue DOR for further explanation if you do. 430 pm EST. INTAX only remains available to file and pay special tax obligations until July 8 2022.

Search for your property. June 5 2019 250 PM. Make an Individual Income Payment.

The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income taxFor more information on the modernization project visit our Project. Wheres My Income Tax. You can see a record of your estimated tax payments in your Revenue Online account.

Tax Liabilities and Case Payments. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Indiana Department of Revenue - DORpay.

Indiana Income Taxes. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

Find Indiana tax forms. Select the Make a Payment link under the Payments tile. This includes making payments setting up payment plans viewing refund amounts and secure.

Have more time to file my taxes and I think I will owe the Department. Tax IDR Up to IDR 50 million. INfreefile was developed in 2003 by the Internal Revenue Service IRS and tax preparation software vendors.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Search by address Search by parcel number. Claim a gambling loss on my Indiana return.

DORpay is a product of the Indiana Department of Revenue. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Follow the links to select Payment type enter your information and make your payment. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. A representative can research your tax liability using your Social Security number.

Effective May 1 2022 the gasoline use tax rate in Indiana for the period from May 1 2022 to May 31 2022 is 0241 per gallon. How do I pay estimated taxes for 2021. To see if you qualify for an installment payment plan attach a Form 9465 Installment Agreement Request to the front of your tax return.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. Rates do increase however based on geography.

Take the renters deduction. To determine if these changes will affect your 2021 estimated tax payments see Estimated tax law changesIf you need to adjust already-scheduled payments due to the new brackets and rates you may cancel and resubmit. If playback doesnt begin shortly try restarting your device.

Pay my tax bill in installments. Find Indiana tax forms. Opens In A New Window.

Claim a gambling loss on my Indiana return. If you have not yet filed your tax return when you reach the File section you have the option to either have the amount due debited from your bank account or you can select the option to mail a checkOr you can use the link below to pay your state taxes due. The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. How do i pay state taxes electronically for Indiana on epay system. INfreefile allows customers with lower adjusted gross incomes AGI to file their federal and state taxes for free using simple question and answer type software.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. There are several ways you can pay your Indiana state taxes. Estimated payments may also be made online through Indianas INTIME website.

When you receive a tax bill you have several options. INtax only remains available to file and pay the following tax obligations until July 8 2022.

Taxation Of Social Security Benefits Mn House Research

Is Indiana Tax Friendly Where Hoosier State Ranks Nationally

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Dor Keep An Eye Out For Estimated Tax Payments

How Do State And Local Sales Taxes Work Tax Policy Center

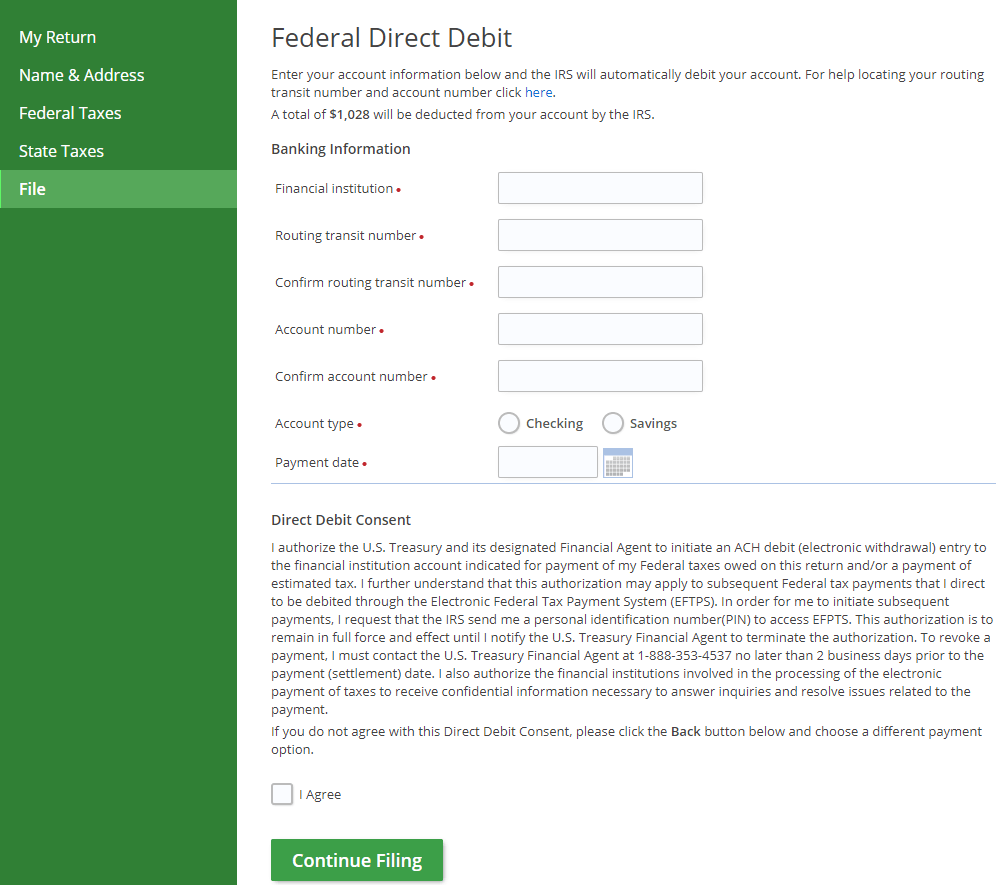

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

How Do State And Local Individual Income Taxes Work Tax Policy Center

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Tax Return Estimated Tax Payments

Where S My State Refund Track Your Refund In Every State Taxact Blog

How Do State And Local Sales Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)